When we use AI, we’re also using the cloud.

With the desirable AI models exorbitant to train and taxing to run, off components both costly and in high-demand—running only with heavy computing power—it’s debatable if the technology could be accessible at all without the shared scaling enabled by cloud computing.

And with massive deals funding AI developers in exchange for a commitment to use only a specific cloud provider, the relationship between these two technologies is increasingly hard to separate.

As AWS CEO Adan Selipsky recently told the Verge: “cloud and AI are not two different things. They’re really just two faces of the same thing.”

Both are also rapidly growing, and increasingly essential to organizations and individuals alike.

But with a growing concentration of the market owned by just three companies, the relationships enabling AI in cloud computing are facing increased outcry and regulatory scrutiny.

In this week’s PTP Report we look at competition and regulation in the cloud market, accelerated by AI.

The Cloud-AI Connection

We all know that AI is not cheap.

And according to Stanford University’s Artificial Intelligence Index Report 2024, it may be even more expensive than you think.

OpenAI’s GPT-4 cost around $78 million of compute just to train, while Google’s multimodal Gemini Ultra required a stunning $191 million. AI models need access to vast amounts of data at speed, with private investment in generative AI octupling(!) since 2022, to $25.2 billion.

With machine learning (ML) in the cloud, according to Stanford, private industry produced 51 notable models in 2023 to academia’s 15, with increased partnerships occurring between the two.

And while there’s optimism AI will become cheaper, more energy-efficient, and practical with new developments and clearly defined use cases, as of now, only the cloud infrastructure and AI partnership at scale makes the technology feasible in mass.

With an original business model focused on database/storage, cloud providers have increasingly found themselves becoming service providers, and now AI providers.

Note that the benefits of scale provided by the cloud are needed just for the end-users.

Developers need access to powerful GPUs and TPUs, managed ML services, and the sheer power necessary drive the machines, and cloud’s vast, accessible data repositories.

The Impact of AI on Cloud Competition

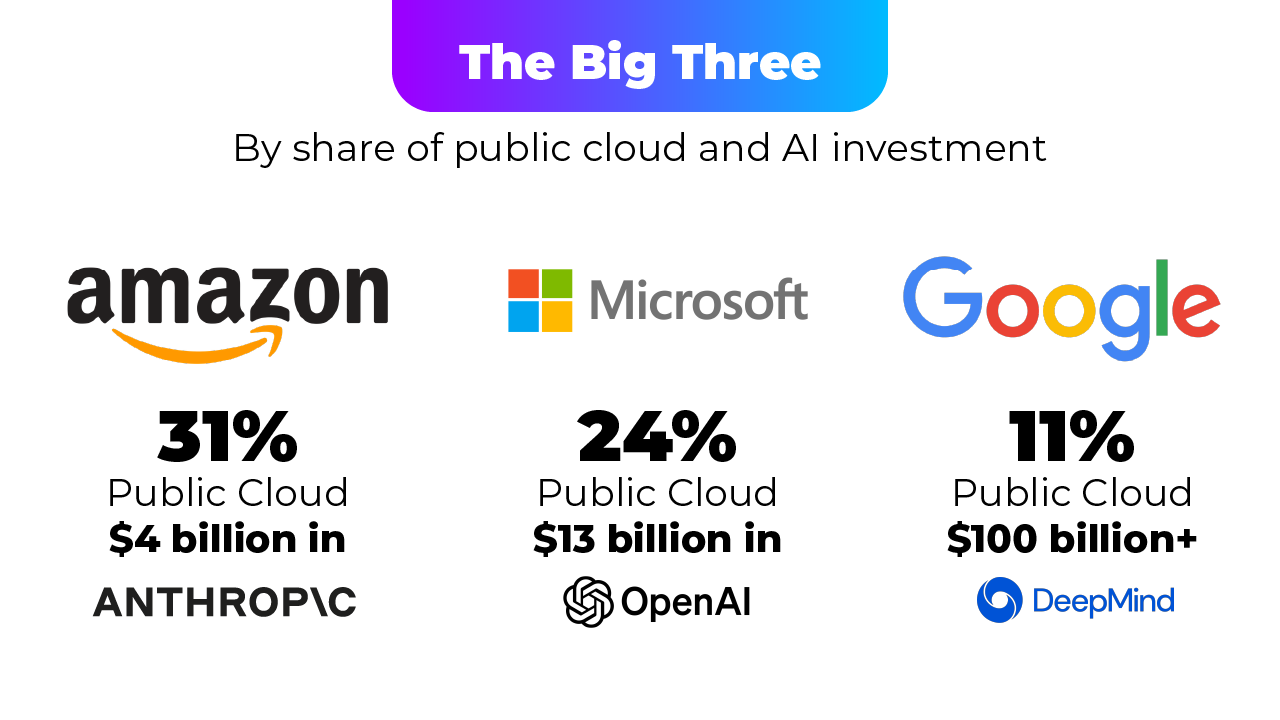

In the public cloud space, just three companies (hyperscalers Amazon, Microsoft, and Google) control some 65% of the entire market.

Amazon’s AWS is the largest of these, running nearly a third of the world’s internet, serving hundreds of millions of users worldwide. AWS went from a way for Amazon to sell off excess storage space to the most profitable part of Amazon’s business.

But now, with AI, Amazon finds itself playing catch-up.

When OpenAI, which captured the public’s imagination with ChatGPT (100 million active users a week), needed funding after a break with co-founder Elon Musk, it was the world’s second-leading (and gaining) cloud provider in Microsoft that was there to give it.

And Microsoft’s $13 billion in funding came in exchange for being the exclusive cloud provider for OpenAI.

Google has long been a leader in AI, acquiring startup DeepMind in 2015 and running them on their own cloud offerings, from Bard to Gemini. Despite some early stumbles, Google is in AI for the long haul, with their AI expenditures predicted to dwarf even the other two hyperscalers in the near term.

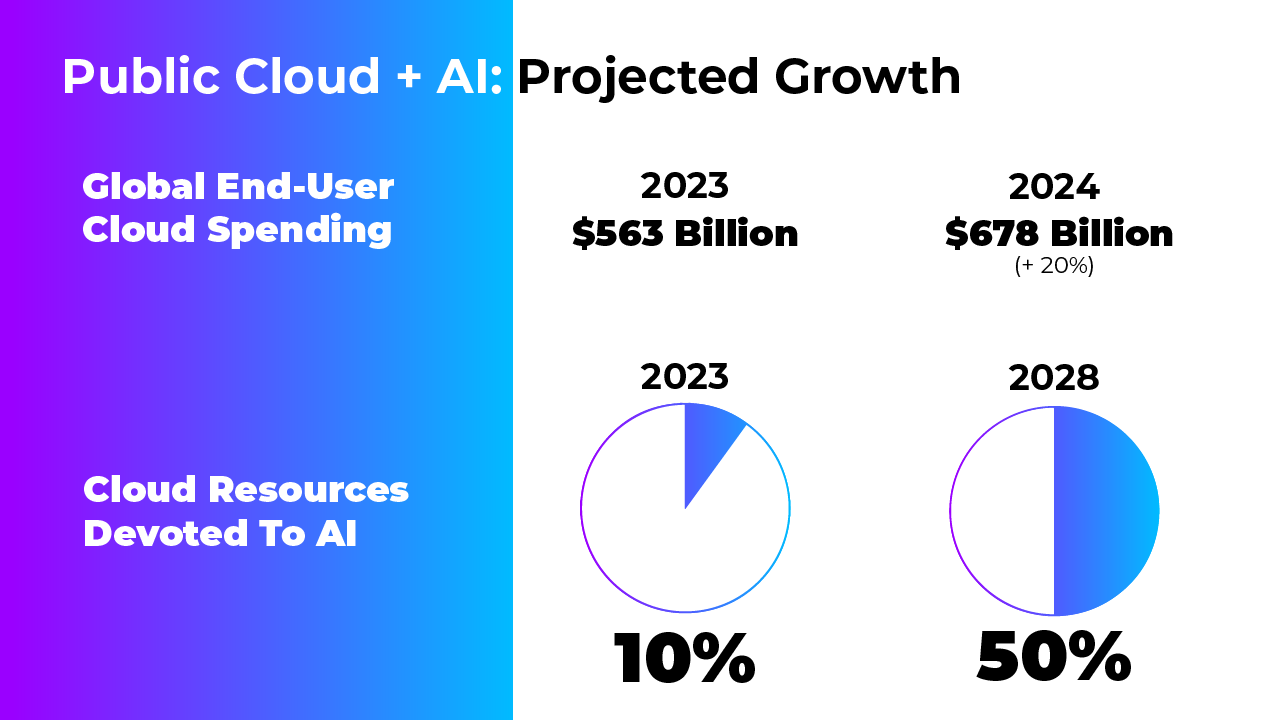

With the percentage of cloud resources dedicated to AI expected to quintuple in just five years, the necessity for cloud companies to lock up AI providers is clear.

Amazon quickly backed Anthropic, founded by former members of OpenAI, with an initial $1.25 billion investment giving them a minority stake. As with Microsoft, this funding requires Anthropic to use AWS for its cloud needs (and Amazon chips), and this year, the investment’s been upped to $4 billion.

And while measuring AI is still an extremely subjective (and tricky) business, Anthropic’s models are competing at a high level, giving Amazon its own, exclusive AI offering to compete with Microsoft and Google.

It doesn’t stop here, of course—Google’s also invested in Anthropic, and Amazon has backed startup HuggingFace, showing that the main cloud providers continue to work to secure alternatives in the finite world of high-end AI offerings.

[Construction of new data centers to power the cloud and AI are also surging, with these same companies in a feverish race to land resources—bottlenecked by a limited power supply and AI GPUs. Check out our PTP Report on the sustainable cloud for more on the data center surge.]

These exclusive agreements and continued consolidation among the cloud giants (e.g. AWS, Azure, GCP) are also catching the eye of regulators around the world, raising concerns about stifled innovation, limited data mobility between cloud providers, and barriers for startups to offer new alternatives.

Concerns and Regulation

The consolidation of the public cloud has been drawing regulatory scrutiny even before the public emergence of AI. But the momentum for regulation of AI in the cloud market is increasing at a rapid pace.

In June 2023, the US Federal Trade Commission warned that as AI “has the potential to rapidly transform the way we live, work, and interact,” and that a limited field of competition “may be able to leverage their control to dampen or distort competition in generative AI markets.”

In his October 2023 executive order, President Biden further warned against issues around antitrust and cloud computing, specifically referencing AI, storage, semiconductors, computing power, and data.

Investigations have been launched in the UK, Japan, the Netherlands, South Korea, and most recently South Africa on cloud data privacy and AI, and broader cloud practices, targeting the extreme concentration of this market and its impact on pricing and competition.

Egress fees—charges for moving data off a cloud provider’s network—have drawn much of the focus, hampering some organizations from embracing a multi-cloud approach. But regulation here has had a significant impact, with Google, followed by Amazon, opting to abolish them.

[For more on cloud fees and vendor lock-in, check out our PTP Report on 2024 cloud trends.]

But expressions of concern and hard regulation are two different things. Microsoft’s relationship with the US government, for example, remains close despite some extremely significant cybersecurity attacks.

On Tuesday (4/16), Microsoft announced a $1.5 billion investment in G42, a United Arab Emirates AI powerhouse in a deal that was facilitated by the US government, aiming to edge out Chinese investment and control.

As part of the deal, G42 will use Microsoft’s cloud services.

Another point of note: despite current enthusiasm in Washington for antitrust discussions around the cloud and big tech, antitrust lawsuits themselves (brought by both private parties and the US government) are significantly down, and continue falling. According to Yahoo Finance, US cases have fallen every year since 2020 (29 cases), down to just 13 cases brought in 2023.

Conclusion

AI is only feasible today at scale, with few companies able to provide the resources necessary for both development and end-use.

Still, such limited distribution, both horizontally (in terms of companies), and vertically (storage, computing services, and increasingly exclusive AI), raises serious concerns around a technology that could become essential to workers.

While AI is a technology that thrives at scale, regulation’s win in the area of cloud portability is evidence it will yet play a role in ensuring that the cloud market isn’t stifled to the consumer’s disadvantage.

Other areas that could benefit from regulatory attention include: greater support for open-source technologies which can aid smaller players get started, data rights for cloud users that ensure more privacy and autonomy over their data, and incentives or incubation for startups, in areas of both cloud computing and AI.

References

Generative AI Raises Competition Concerns, Federal Trade Commission

Where the battle to dominate AI may be won, CNN Business

CMA launches market investigation into cloud services, Gov dot UK

There’s no AI without the cloud, says AWS CEO Adam Selipsky, The Verge

Executive Order on the Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence, The White House

Antitrust fervor is gripping Washington and Silicon Valley. But lawsuits have been declining, Yahoo Finance

Microsoft Makes High-Stakes Play in Tech Cold War With Emirati A.I. Deal, New York Times