Enterprise Resource Planning (ERP) systems—which integrate process management and planning—have long been a staple of big business.

The consolidation of business technology—from procurement to distribution and accounting to governance to sales—provides companies with greater visibility, better tracking and forecasting, stronger security, and smoother company-wide shifts.

But they’re also often synonymous with complexity and scale, conjuring monolithic on-prem solutions. Utility over innovation. Safety over sizzle.

With the top providers (including SAP, Oracle, Microsoft) controlling a sizeable chunk of the market, these systems can also be slow-moving, waiting for wide adoption and stability before they capitalize on the latest breakthroughs.

Recently we covered the impact the AI revolution is having on the SaaS industry, and today we consider the impact it’s had on another massive software company, SAP.

How SAP Became Europe’s Biggest Tech Company

Founded in 1972 by engineers from IBM, SAP isn’t an overnight success.

As the largest non-American software company by revenue, and the world’s fourth-largest software company (per Yahoo! Finance), they have more than 400,000 global customers. They provide ERP solutions for companies like Walmart, Exxon, Apple, Chevron, Alphabet, and AT&T.

And while they’ve long been a top name for ERP, SAP made news in late March for reaching a new milestone: becoming the largest company in Europe by market cap. This follows a period of underperforming rivals, with their growth failing to match that of more fleet competitors.

In recent years, things have changed. SAP outperformed other cloud ERP leaders in 2025 and over the past three years beat rivals Microsoft (+25%), Oracle (+63%), Adobe (-22%), and even Salesforce (+28%) with their own growth (+125%).

Since the end of 2022, SAP’s 160% surge dwarfed the European STOXX 600 index (an average of 28%), even with 2024 dips for restructuring.

And they attribute this surge to their successes in cloud and AI execution.

The SAP Cloud Transformation: Getting AI-Ready

SAP’s cloud offerings aren’t new—their S4/HANA cloud-based system dates back a decade. But some have been hesitant to embrace cloud-based ERP.

From data security to lock-in to customization, many customers have preferred their on-prem solutions. SAP has been able to change this calculus over the past three years.

One benefit in the HANA solution is that it stores data in the main memory and cache (vs row by row), enabling queries to be executed in real-time. This eliminates data extraction across tables via queries for display. Along with the data model’s simplification, their GUI redesign aimed to reduce changes and unify the interface across devices.

But it’s been successful AI implementation and smart incentives that have provided much of the impetus for the move. Their unified platform (BTP) follows a pattern established by industry leaders like Salesforce and Microsoft—with a cloud-based server focused on data, using apps for processing and display.

This has cleared the way for improved analytics and AI.

BDC: Backed by the SAP Databricks Partnership

SAP recently unveiled their Business Data Cloud (BDC), which combines structured and unstructured data from across sources, both internal and external, able to combine relational databases (Oracle, Microsoft SQL Server), cloud storage (Amazon S3, Google Cloud), and enterprise apps (Salesforce, ServiceNow, Workday).

This makes it easier to break up monolithic ERP models and use SAP services alongside third-party SaaS like Salesforce and Oracle offerings, though it can also limit or duplicate benefits (see below).

A main draw comes from the partnership with Databricks, which brings its proven AI and analytic capabilities to bear.

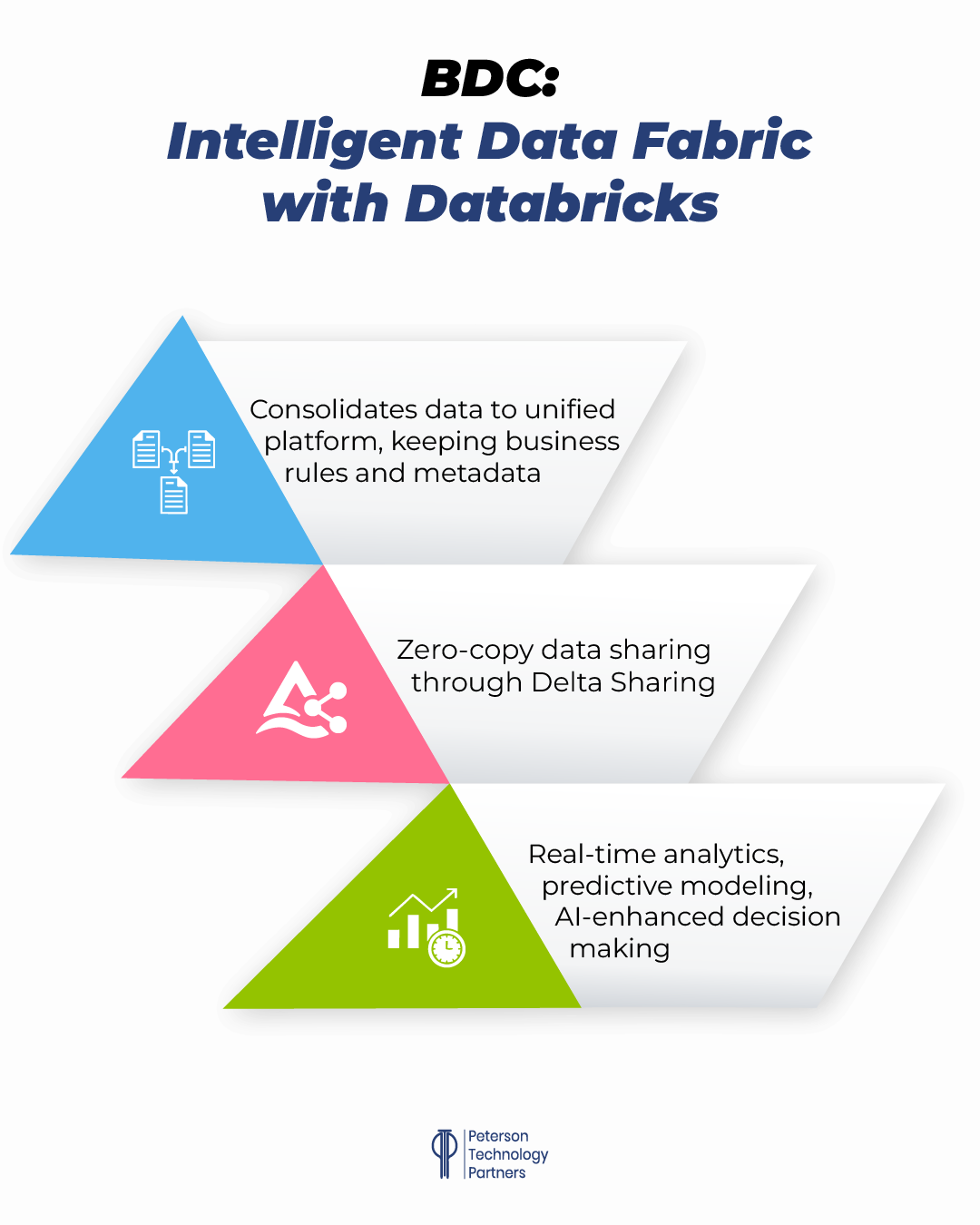

SAP’s BDC utilizes a data fabric architecture to help move off data silos and better capitalize on what AI has to offer. Named for its weaving together of sources without the need for duplication, it enables unified governance, security, analysis, and delivery.

It also maintains business rules and metadata from their original sources, keeping area context while enabling real-time analytics.

SAP CEO Christian Klein said of the Databricks partnership:

“We decided to collaborate after seeing that over 1,000 customers have already contacted us about utilizing the two companies’ data platforms together.”

And the market has followed through, with a $650 million pipeline established within two weeks of launch.

Still, all of these benefits won’t be available to all customers. While SAP has maintained on-prem support, these innovations are focused on the managed cloud. Companies that are already using third-party solutions may find redundancies, and there are more benefits available for customers of both SAP and Databricks.

And as with other such partnerships, should Databricks be acquired or alter their services, it could limit the BDC offerings. As with other cloud solutions, the dependence on a specific system also raises the possibility of lock-in that limits a client’s flexibility.

AI + ERP: Joule and the SAP Nvidia Collaboration

All this is also geared to enable SAP to grow their Joule AI copilot offerings.

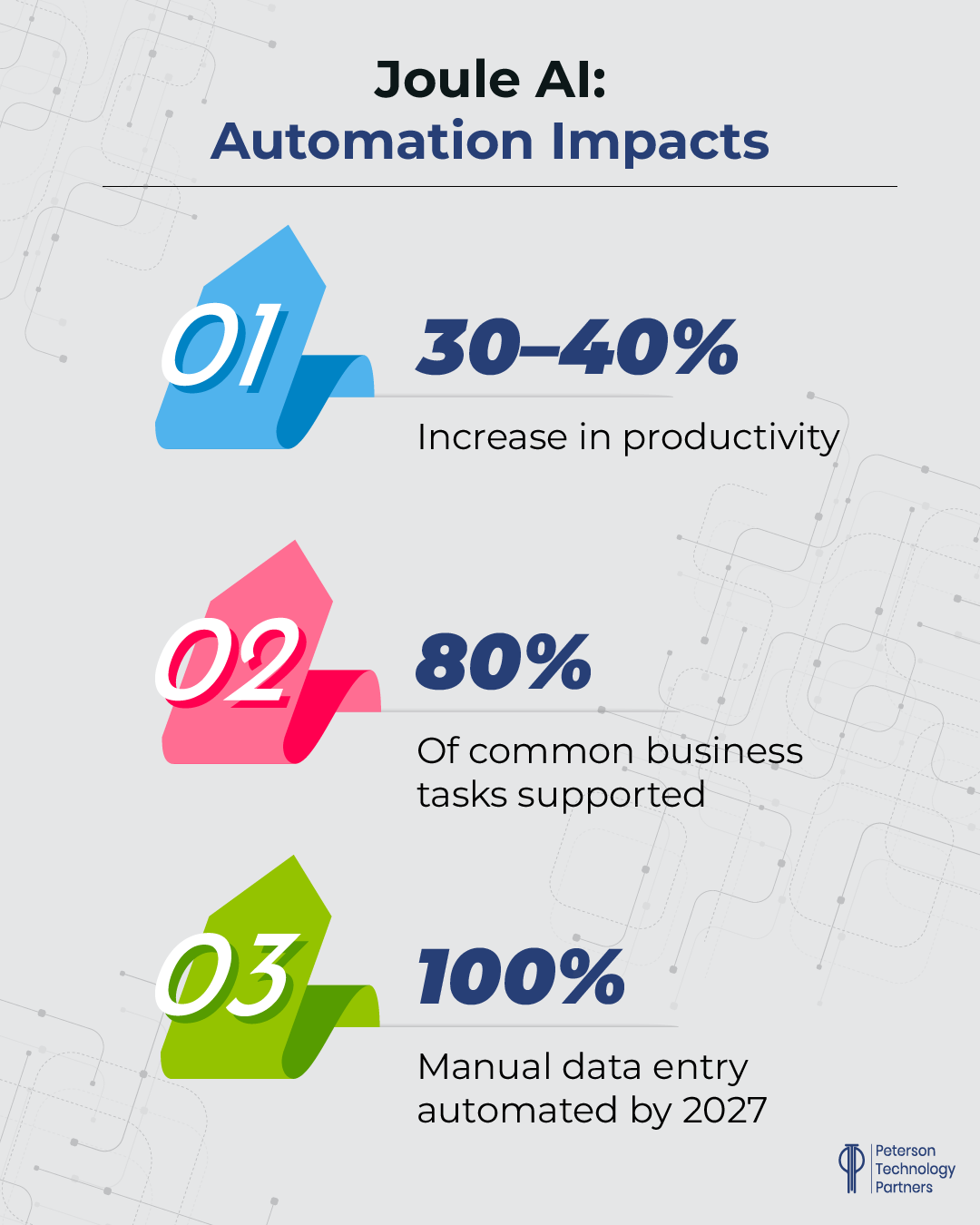

Like other high-end enterprise SaaS AI systems, Joule aims to do more than NLP chatbots, automating 1,300+ SAP workflows. It brings AI assistance to tasks from vendor onboarding to processing invoices to generating quotes to analyzing budget comparisons.

And Joule got much smarter in 2025. A partnership with Nvidia integrates their Llama Nemotron reasoning models from the NeMo platform with a goal of adding agentic advances in the same vein as Salesforce.

These aim to move past working from user requests, allowing AI to:

- Field natural language questions for guidance and interpretation of SAP’s ABAP code

- Generate, test, and troubleshoot the code more efficiently

- Manage complex logic trees across finance approvals

- Enable SAP digital twin technology for 3D real-time product visualizations

- Simulate workflows and entire supply chains, improving factory layouts

- Develop their own proprietary agentic solutions

CEO Christian Klein believes these innovations will see the end of manual data entry in their products within the next three years.

Limitations and Challenges

AI solutions have meant opportunities and risks for large software providers, forcing SaaS providers to adjust and re-design offerings or risk being left behind. The same is true with ERP.

SAP has adjusted effectively, launching programs to encourage customers to move into the cloud and providing them the means to harness AI. Still, challenges remain.

SAP’s agentic AI innovations are bringing value but aren’t as striking yet as the capacities demonstrated by Salesforce, for example. But they’re moving fast, showing a willingness to remain fleet and adaptive.

Also true to reputation, migration from legacy systems remains highly complex, requiring specialized support and extensive process adjustment to take advantage of all offerings.

Companies that use AI through vendor systems risk lock-ins as mentioned above, and while there is extensive support for compliance, moving to the cloud can pose additional challenges for those in highly regulated industries.

IBM infrastructure spin-off Kyndryl, the world’s largest IT infrastructure services provider, recently underwent its own ERP migration to SAP S/4HANA and has provided some detail on their experience. Their transformation coincided with SAP’s own technological adaptation, and it took them 18 months to complete the overhaul of their processes. (Their finance team, for example, went through more than 50 iterations of their ledger.)

They focused on cleaning up their own data systems to improve AI adoption and recommend that other businesses begin here.

As Kyndryl SVP Michael Bradshaw told CIO Dive’s Matt Ashare:

“What companies need to do right now is build a foundation of data in order to be able to take advantage of whatever AI capabilities they want to leverage, whether it’s through SAP, Microsoft or a custom LLM… A lot of AI POCs don’t go further than the POC because they’re not in an environment that is allowing them to scale.”

PTP, SAP, and Maximizing Your AI Strategy

Enterprise resource planning trends, as with other platforms, point to finding safe and reliable ways to harness AI and that often means the cloud and finding ways out of data silos that stand in the way.

PTP can provide talented people with SAP experience, and also the cloud experts, data scientists, and AI/ML professionals that businesses need to make their own pivots. Whether your company is adapting its own ERP, looking to deploy custom AI, or harnessing the benefits of other data fabric architectures, consider PTP for your talent needs.

With more than 27 years of experience providing tech talent for some of the world’s largest companies, PTP has flexible solutions for onsite or off, with onshore, nearshore, and offshore reach.

Conclusion

AI is here and changing fast, dangling massive efficiencies and analytical capacities before companies but without a clear route for implementation. With complex pricing, uncertain safety, and untested edges, moving past experimentation and into ROI can seem excessively risky.

The same challenges are being faced by large software and tech service providers. SAP, like Salesforce, Microsoft, and others, has moved fast and effectively into AI, reinventing their cloud offerings through tactical investments, innovations, and an array of partnerships.

SAP has successfully leveraged their position in ERP, and now the cloud accounts for the majority of their revenues, with 2025 continuing a trend of strong cloud growth.

This transformation hasn’t just made them Europe’s most valuable company—it’s also an intriguing example of how legacy tech companies can adapt to help their own customers move safely into the AI future.

References

Software maker SAP unseats Novo Nordisk as Europe’s largest company, Reuters

SAP Cloud Finally Comes Of Age, Seeking Alpha

What SAP’s Business Data Cloud Means For Enterprises, Forbes

SAP Finance Automation: The Vision of Parveen Singh Hoshiar Singh, The Street Roundtable

SAP CEO Christian Klein predicts manual data entry will disappear from SAP by 2027 and SAP joins the AI agent era — but not all customers may benefit, CIO

Building a business data fabric: SAP Datasphere vs. DIY implementations, SAP Technology Blog

Kyndryl rolls out SAP services suite inspired by its own migration story, CIO Dive

FAQs

How do enterprise solutions like SAP ensure AI outputs remain compliant with regulations?

This is one benefit for companies utilizing AI through providers like SAP and Salesforce. Building on a legacy of supporting regulated businesses in ERP, SAP has prioritized auditability, with Joule outputs both traceable and tied to business logic. This enables finance, HR, and healthcare services, for example, to better meet regulatory requirements.

How does SAP compare to Salesforce in terms of their AI strategy?

Salesforce is dominant in customer relationship management (CRM), while SAP’s strength lies in core ERP, supporting finance, procurement, HR, manufacturing, and supply chain.

Salesforce has demonstrated impressive agentic innovations, as SAP’s Joule copilot is coming on strong in 2025. Both have partnerships with Databricks, and in SAP’s case, it is part of the data fabric architecture offering with their BDC, which can itself integrate with Salesforce.

What steps should organizations take to prepare for cloud-based AI innovations like SAP’s?

If working with an ERP now, start by evaluating where the systems could be restricting agility now. If not using AI, upskill your teams with new data modeling and AI functionality, and begin preparing your data ASAP. To scale with AI from any provider, companies need a strong data foundation.